Accounting Year Configuration

Welcome to AccuBooks Configurations of Accounting Year. This configuration allows you to set your Accounting Year, also known as a fiscal year or financial year.

Importance of Setting Up Your Accounting Year

1. Standardization and Comparability: An accounting year standardizes the financial reporting period, allowing for consistent and comparable financial statements. This helps stakeholders, such as investors, creditors, and management, to compare financial performance and position over time and across different entities.

2. Regulatory Compliance: Many regulatory bodies and tax authorities require businesses to report their financial results on an annual basis. Setting an accounting year ensures compliance with these legal and regulatory requirements.

3. Tax Calculation and Reporting: The accounting year is often aligned with the tax year as defined by tax authorities. This alignment simplifies the calculation and reporting of taxes, as businesses can prepare their tax returns based on the financial data of the accounting year.

4. Budgeting and Planning: An accounting year provides a defined period for budgeting and financial planning. Businesses can set financial goals, allocate resources, and evaluate performance against the budget over a specific timeframe.

5. Performance Measurement: By setting an accounting year, businesses can measure financial performance on an annual basis. This includes tracking revenues, expenses, profits, and other key financial metrics, enabling better performance analysis and decision-making.

6. Internal Control and Audit: The accounting year establishes a regular cycle for internal controls and audits. Regular financial audits, whether internal or external, are often conducted at the end of the accounting year to ensure accuracy and integrity of the financial statements.

7. Stakeholder Communication: Financial statements prepared at the end of the accounting year are used to communicate financial performance and position to stakeholders, including shareholders, creditors, employees, and the public. This transparency builds trust and confidence in the business.

8. Seasonal Business Considerations: For businesses with significant seasonal variations in their operations, setting an appropriate accounting year can help in better capturing and reflecting their financial activities. This ensures that financial statements provide a true picture of the business's performance.

Accounting Year User-Manual

Below is set of instructions to set up, and configure your Accounting Year.

Note

System Specifications may vary based on your needs and requirements.

Note

Choosing a year automatically sets the start and end date from the first and the last day of the year.

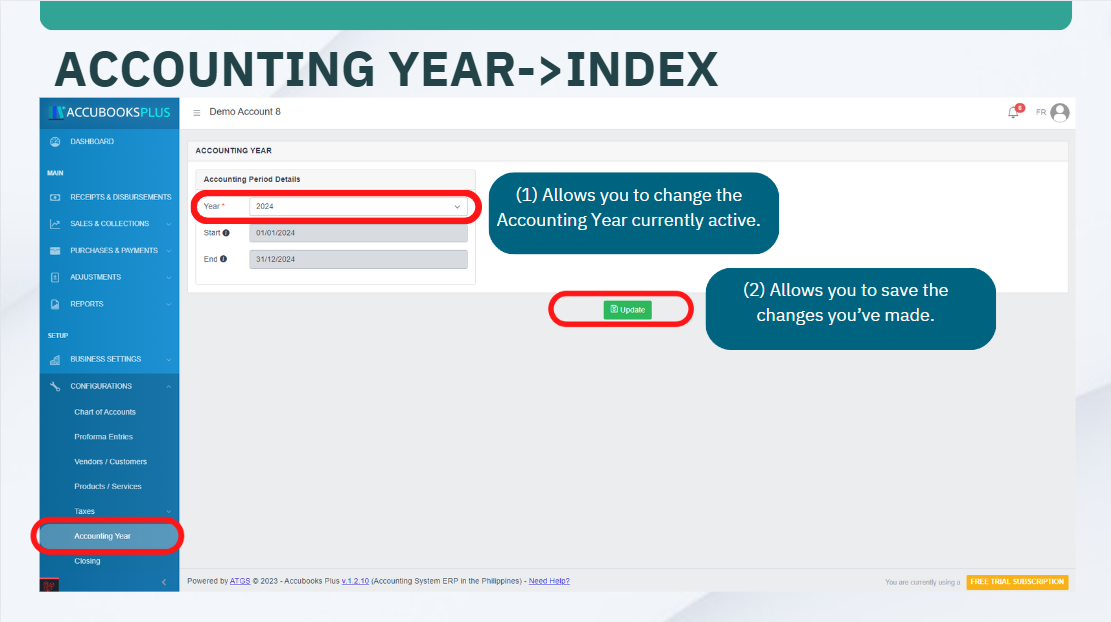

Accounting Year Index User-Manual

The Chart of Accounts index page shows the data of all accounts stored in the system. You can select the table’s paging, ordering and sorting. You can also look for a certain account by using the search function.

(1). You can see the currently applied accounting year, the start and the end date.

(2). You can also select a year by clicking the dropdown and click the update button to change the applied accounting year easily.

Setting an accounting year is essential for organizing, managing, and reporting financial activities in a structured and standardized manner, facilitating better financial oversight and strategic decision-making.