Chart of Accounts Configuration

Welcome to AccuBooks Configurations of Chart of Accounts (COA). A Chart of Accounts serves as the backbone of your financial recording process, providing a structured framework for categorizing and organizing all financial transactions within your business or organization.

This guide will walk you through the fundamental principles of designing and implementing a Chart of Accounts tailored to meet the specific needs and requirements of your entity. Whether you are establishing a new COA from scratch or refining an existing one, understanding the significance of each account and its placement within the hierarchy is crucial for accurate financial reporting and decision-making.

We will explore the key components of a Chart of Accounts, including the classification of accounts by type, the importance of a standardized numbering system, and the considerations for accommodating the unique aspects of your business operations. Additionally, we will discuss best practices for maintaining flexibility and scalability within your COA to adapt to changes in your organization's structure, industry dynamics, and regulatory requirements.

By the end of this guide, you will have the knowledge and insights necessary to develop and set-up a robust Chart of Accounts that not only facilitates efficient financial management but also serves as a strategic tool for driving business growth and success. Let's embark on this journey to optimize your accounting system and unlock the full potential of your financial data.

Key Purposes

1. Recording Financial Transactions: The COA is used to systematically record all transactions in the company's or organization's general ledger. This ensures that all financial activities are accurately documented and categorized.

2. Organizing Financial Data: The COA groups accounts into categories such as assets, liabilities, equity, revenue, and expenses. This organization helps in maintaining a clear and structured financial record.

3. Providing Unique Identifiers: Each account in the COA is assigned a unique code to prevent duplication. This uniqueness is crucial for maintaining data integrity and ensuring that transactions are recorded correctly without errors.

4. Customizing and Adding Accounts: The system allows users to add new accounts to the COA, specifying the type (asset, liability, equity, revenue, or expense) and providing descriptions. This flexibility enables users to tailor the COA to their specific needs.

5. Editing and Managing Accounts: Users can edit existing accounts and update their details as needed. The ability to mark accounts as active or inactive allows for better management and control of financial data.

6. Bulk Importing Accounts: The system provides a feature to import multiple accounts using a predefined template. This functionality is essential for efficiently setting up or updating the COA, especially when dealing with a large number of accounts.

7. Exporting Accounts for Reporting: The COA can be exported for use in other reporting contexts. This feature is useful for generating comprehensive financial reports and ensuring that all necessary account information is readily available for analysis or compliance purposes.

These purposes highlight the COA Configuration's role in ensuring accurate, organized, and efficient financial management within the accounting system.

Complete Walkthrough Video

Chart of Account Types

Chart of Account Types is the list of all subclassification of the different chart of account. The Chart of Accounts (COA) in the accounting system is categorized into the following types:

1. Assets: Accounts related to the resources owned by the company, such as cash, accounts receivable, inventory, and property.

2. Liabilities: Accounts representing the company's obligations or debts, such as accounts payable, loans, and mortgages.

3. Equity: Accounts that reflect the owner's interest in the company, including common stock, retained earnings, and additional paid-in capital.

4. Revenue: Accounts for income earned from the company's primary business activities, such as sales revenue and service income.

5. Expenses: Accounts that track the costs incurred in the process of earning revenue, such as salaries, rent, utilities, and supplies.

These categories are used to systematically record and organize financial transactions in the company's general ledger, ensuring comprehensive and structured financial reporting.

Chart of Accounts Module User-Manual

Below is a step-by-step instructions to effectively set up, configure, and maintain chart of accounts records.

Note

System Specifications may vary based on your needs and requirements

Chart of Accounts Module Index User-Manual

-

The Chart of Accounts index page shows the data of all accounts stored in the system. You can select the table’s paging, ordering and sorting. You can also look for a certain account by using the search function.

-

You can import, export and add accounts on the table.

-

Click the corresponding folder button to check and manage a certain account .

You can also change the order and sorting of products and services by their Code, Name, Type, and by their Description- ascending or descending.

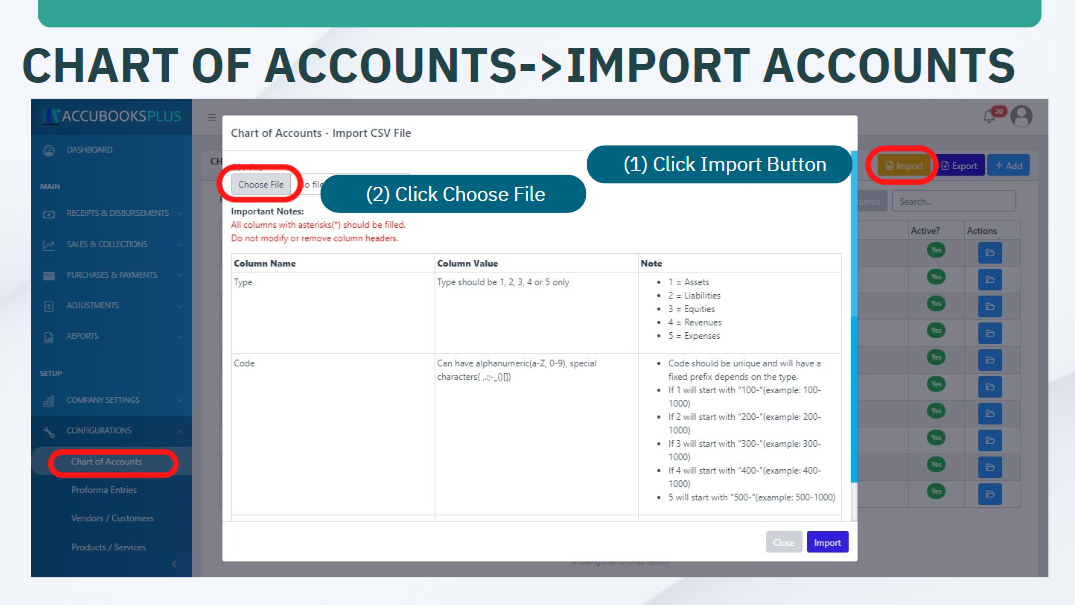

Chart of Accounts Module Import User-Manual

This feature allows a user to import bulk data.

-

To start, click the yellow import button.

-

Click Choose File button.

-

Select the file that you want to import.

-

Click Open button.

-

Click Import.

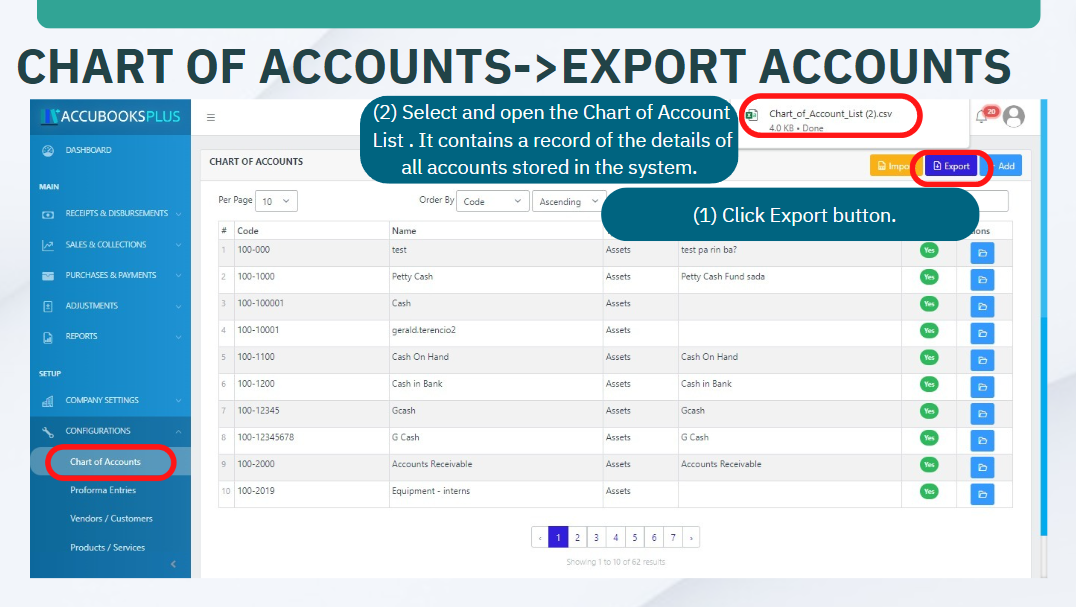

Chart of Accounts Module Export User-Manual

This feature allows you to export all available data.

-

To start, click the dark blue Export button.

-

Select and open the Chart of Account List. It contains a record of the details of all accounts stored in the system.

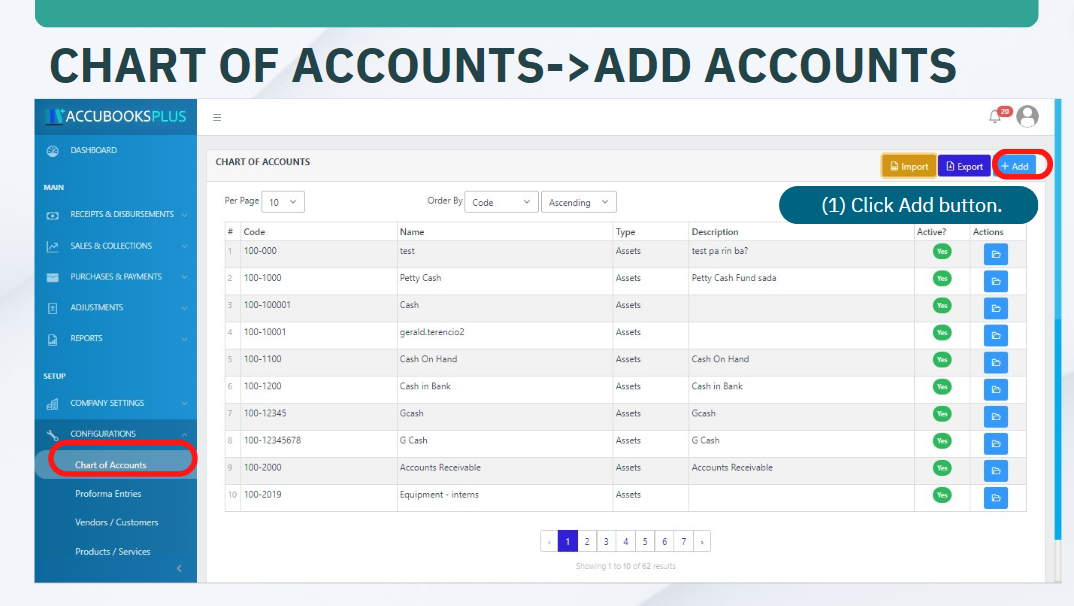

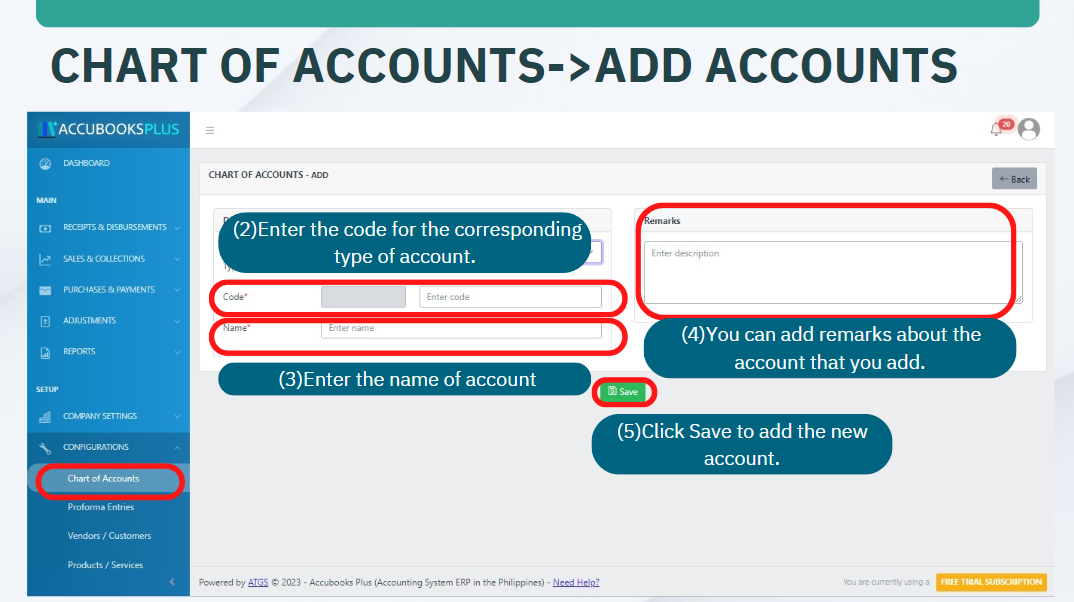

Chart of Accounts Module Add User-Manual

This feature allows you to add a new Chart of Account.

- To start, click the Add button.

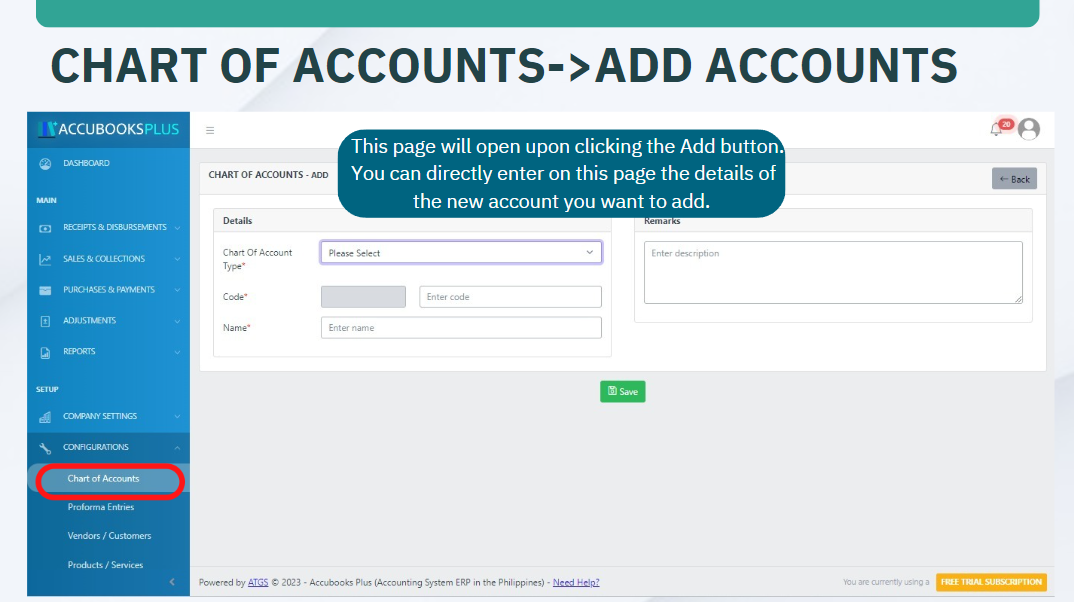

- This page will open upon clicking the Add button. You can directly enter on this page the details of the new account you want to add.

- Select the Chart of Account type.

-

Enter a unique code for the corresponding type of account.

-

Enter the name of the account.

-

You can add remarks about the account that you are adding.

-

click Save to add a new account.

Chart of Accounts Module Show User-Manual

This Feature allows you to view more information about a product/service.

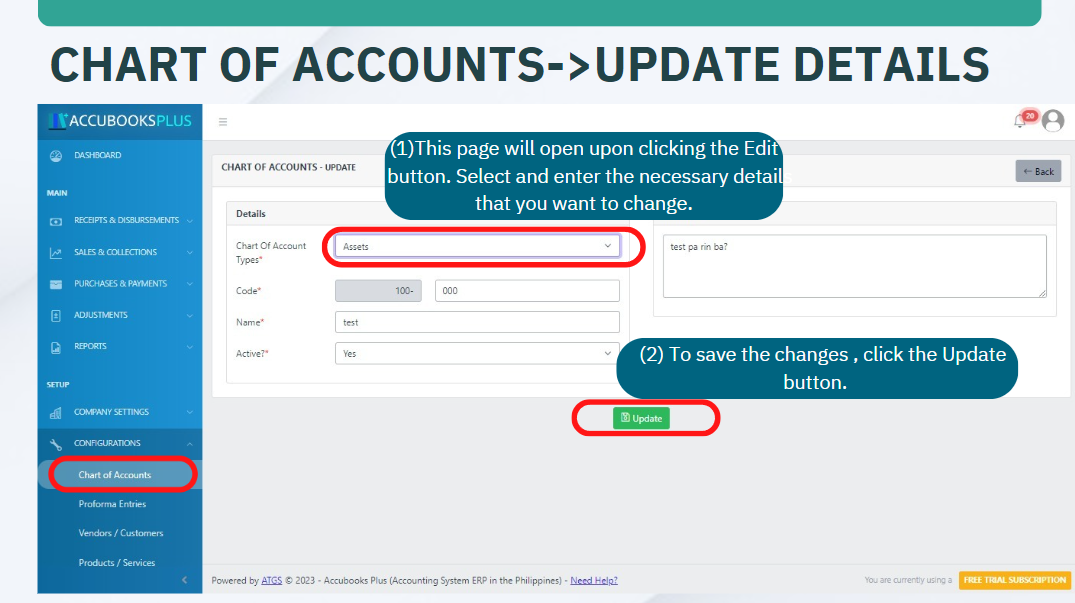

Chart of Accounts Module Update User-Manual

This feature allows you to edit and update existing Chart of Account data.

- To start, click the light blue Edit button to start editing Chart of Account data.

Clicking the edit button allows you to edit the details of products/services.

-

This page will open upon licking the Edit button. Select and enter the necessary detail that you want to change.

-

To save the changes, click the light green Update button.

Chart of Accounts Lists is the list all the chart of account applicable to the company's operations with complete details.

Chart of Account Ledgers - Ledgers in the system are used for grouping and classifying the Chart of Accounts Lists into subgroups.

Note

Chart of Account Groups and Types are default values in AccuBooks Accounting System. There are also default values under Chart of Account Lists essential for proforma entries.